As being the electronic overall economy continues to evolve, the intersection of accounting and taxation with emerging systems has grown to be progressively crucial. Especially, the rapid increase of cryptocurrencies and decentralized finance has supplied start to new difficulties and alternatives in economical reporting, compliance, and strategic organizing. Classic economic specialists now discover them selves adapting for the complex realities of digital property, blockchain know-how, and token economies. This shift has introduced the need for specialized roles, such as a bitcoin accountant, and has produced need for area of interest companies like blockchain audit, blockchain bookkeeping, and blockchain tax consulting. These improvements are In particular applicable for just about any blockchain startup looking to navigate the unsure regulatory terrain whilst ensuring operational efficiency and transparency.

In these days’s rapid-paced economical natural environment, businesses and persons are participating with electronic belongings like hardly ever in advance of. This engagement has brought about a wholly new sector within the accounting occupation, the place classic strategies normally tumble wanting capturing the complexities of copyright transactions. A bitcoin accountant is now an essential asset to any individual or Group involved with buying and selling, Keeping, or transacting in cryptocurrencies. These professionals should possess a deep idea of both the know-how underlying electronic currencies as well as frequently shifting tax restrictions bordering them. Such as, although fiat forex transactions are uncomplicated to record and report, copyright transactions can contain numerous wallets, token swaps, staking rewards, and decentralized exchanges, all of which introduce a large number of tracking and reporting problems.

Blockchain bookkeeping, Within this context, gets an important operate. Contrary to conventional bookkeeping, wherever entries are typically tracked in a linear and relatively easy trend, blockchain bookkeeping demands an idea of public and private ledgers, transaction hashes, smart contracts, and gasoline charges. The decentralized mother nature of blockchain implies that documents are immutable and clear, but extracting and interpreting this details for economical statements or audits involves Highly developed software applications as well as experience of educated experts. For startups and set up organizations alike, employing a bitcoin accountant or maybe a blockchain bookkeeping professional makes sure that their fiscal programs continue being compliant with regulatory expectations and they are able to withstanding scrutiny for the duration of an audit.

A blockchain audit differs from a conventional economic audit in important means. Although a conventional audit focuses on verifying the precision of monetary statements determined by files like invoices and receipts, a blockchain audit need to assess transactions recorded on dispersed ledgers. These audits may well include verifying the existence and movement of copyright property, evaluating the effectiveness and integrity of sensible contracts, and ensuring that the recorded facts about the blockchain matches the business’s interior fiscal information. This type of audit involves not just a deep understanding of monetary principles but additionally the technical capacity to interpret blockchain information. As such, a blockchain audit staff often contains each Qualified accountants and blockchain developers to bridge the hole among finance and technological innovation.

For a blockchain startup, the road to accomplishment is crammed with regulatory and economical difficulties. These companies will often be constructed on ground breaking ideas that thrust the boundaries of present rules and accounting standards. Regardless of whether launching an Preliminary coin presenting (ICO), establishing a decentralized software (dApp), or developing a token economy, these startups have to regulate elaborate financial functions through the outset. Accounting and taxation considerations are vital for their survival and progress. Incorrect dealing with of token income, insufficient compliance with tax restrictions, or bad fiscal transparency can not just bring about lawful penalties but can also erode Trader belief. Consequently, integrating Skilled services which include blockchain tax consulting and blockchain bookkeeping from the beginning is really a strategic go for just about any blockchain startup.

Blockchain tax is Just about the most dynamic and difficult places in present day taxation. As opposed to common economical belongings, cryptocurrencies would not have a steady classification across jurisdictions. In a few international locations, they are handled as residence, while in Other folks They are really viewed as forex or perhaps commodities. This results in difficulties for individuals and firms in reporting gains, losses, and profits derived from copyright things to do. A bitcoin accountant specializing in blockchain tax will help navigate these complexities by tracking Value foundation, calculating capital gains, and making certain compliance with local and Global tax regulations. The decentralized and anonymous character of numerous copyright transactions also means that tax authorities are getting to be a lot more vigilant, building exact and clear reporting far more crucial than ever.

The emergence of blockchain technologies has also disrupted how businesses deal with interior controls and compliance frameworks. When the technological know-how by itself offers transparency and traceability, employing these features into a cohesive economic reporting process is not clear-cut. Blockchain bookkeeping requires to include reconciliation resources that make sure that sensible contract outputs and token transfers align with predicted outcomes. Any discrepancies should be investigated and corrected swiftly to stop financial inaccuracies. In addition, an intensive blockchain audit may help discover weaknesses in these controls and advise enhancements that enhance the In general reliability and trustworthiness in the monetary devices in position.

Furthermore, accounting and taxation pros must regularly update their know-how as new use conditions and economical instruments carry on to emerge inside the blockchain House. Such as, the rising recognition of decentralized finance (DeFi) introduces complexities like generate farming, liquidity pooling, and governance token distributions, all of which carry tax implications. Similarly, NFTs (non-fungible tokens) add One more layer of complexity due to their exceptional features and valuation complications. A bitcoin accountant who understands these subtleties might help consumers adequately account for these belongings, establish tax obligations, and system their funds accordingly.

As blockchain gets to be additional mainstream, companies that are not instantly associated with copyright also are starting to integrate blockchain into their operations. Which means even common corporations will have to now take into account how blockchain impacts their accounting techniques. Good contracts, As an example, automate and implement the execution of contractual obligations, but In addition they pose new worries for accounting and taxation. Pinpointing when profits is acquired or charges are incurred in a sensible contract natural environment may perhaps differ from conventional solutions, demanding new accounting products and tax interpretations. Professionals skilled in blockchain audit and blockchain tax Engage in a essential purpose in encouraging providers adapt to these modifications.

In terms of compliance, regulatory bodies throughout the world are catching up With all the swift rate of blockchain innovation. Governments are introducing new guidelines and guidelines to make certain that copyright transactions are correctly noted and taxed. This makes a dual responsibility for both of those people today and corporations to remain educated and compliant. A blockchain startup that fails to comply with these restrictions threats large fines, lack of Trader confidence, and in some cases organization closure. Dealing with a bitcoin accountant as well as a blockchain audit staff can mitigate these dangers by making certain that each one money and tax obligations are met in a very timely and exact way.

In addition, the role of data analytics in blockchain bookkeeping has started to become additional pronounced. Blockchain generates a vast amount of transaction data that can be mined for insights into small business functionality, operational performance, and monetary health. State-of-the-art analytics tools, frequently powered by AI, can detect anomalies, forecast developments, and automate reconciliations, thereby enhancing the worth of blockchain bookkeeping. These insights are significantly beneficial for a blockchain startup, in which timely and precise facts can make the difference between good results and failure inside of a extremely aggressive environment.

The scalability of accounting methods is an additional problem that blockchain startups ought to handle early on. As they grow, their transaction volumes may raise exponentially, requiring scalable accounting and taxation devices which can take care of substantial amounts of serious-time info. Cloud-based accounting answers integrated with blockchain analytics can provide the flexibleness and capability necessary to scale efficiently. A bitcoin accountant familiar with these equipment can manual startups in choosing the suitable programs and ensure easy implementation.

Possibility administration is usually a important problem inside the blockchain Area. The volatile mother nature of copyright belongings as well as relative infancy of your engineering increase publicity to financial, operational, and regulatory pitfalls. Blockchain audit processes that incorporate chance assessment frameworks may also help determine prospective threats and place controls in position to mitigate them. Additionally, ongoing blockchain tax planning ensures that entities usually are not caught off guard by surprising tax liabilities, specifically in jurisdictions with intense tax enforcement procedures.

A different region the place blockchain intersects with accounting and taxation is cross-border transactions. Blockchain allows instant world wide transactions, but these feature challenges associated with exchange fees, tax treaties, and jurisdictional compliance. A bitcoin accountant with skills in international blockchain tax can assist businesses construction their functions to minimize tax liabilities and be certain compliance across borders. This is particularly vital for any blockchain startup with world-wide aspirations, given that the complexity of handling Global economic obligations may be overwhelming with no pro steerage.

Education and teaching are basic into the thriving integration of blockchain into accounting techniques. Universities and Skilled bodies are starting to consist of blockchain technological know-how and digital asset taxation within their curricula, recognizing the need for bitcoin accountants and blockchain audit pros. Steady Skilled growth With this space makes sure that accountants stay pertinent and effective inside a swiftly modifying monetary landscape.

Lastly, rely сryрto Accountant on and transparency are in the core of accounting and taxation. Blockchain’s inherent Attributes support these values by supplying an immutable history of transactions. On the other hand, leveraging this know-how proficiently involves a sophisticated idea of both of those its abilities and restrictions. By investing in experienced industry experts who specialise in blockchain bookkeeping, blockchain tax, and blockchain audits, firms can greatly enhance their fiscal integrity and stakeholder self-confidence. Regardless if you are a blockchain startup laying the foundation for long run development or an established small business looking to innovate, aligning your monetary programs with blockchain greatest procedures is not simply a choice—it’s a requirement while in the digital age.

Taran Noah Smith Then & Now!

Taran Noah Smith Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Tina Majorino Then & Now!

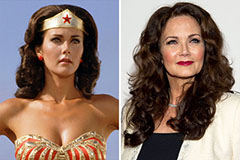

Tina Majorino Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!